Restaurant Rockstars Episode #308

Killer Advice from a Restaurant Lease Expert

LISTEN HERE OR ON YOUR FAVORITE PODCAST PLAYER

Prefer to watch the interview?

Click the video below.

Many of us lease space for our restaurants.

Those looking to expand or open a new business need to evaluate many space options and then negotiate their best deal and terms.

It has been said that “You don’t get what you deserve, you get what you negotiate”! To come out on top, takes experience and the right approach.

In this episode of the Restaurant Rockstars Podcast, I’m speaking with Dale Willerton aka “The Lease Coach”.

Listen on as we get the inside scoop on:

- How to select the best space for your concept

- Finding the balance between lease cost vs. location

- What is a “Profitable Lease Agreement”

- Lease concessions you should ask for

- Common Area Maintenance (CAM) Charges and what’s reasonable

- What’s important at renewal time

And the benefits of hiring an expert to negotiate your lease for you.

This episode is a must-listen.

Now go Rock YOUR Restaurant!

Roger

Connect with Dale:

Guest 0:00

80% of the time Roger, the tenant has the advantage no matter what the economy is, no matter what’s going on, they just don’t know it. It’s like being the strongest man in the room and they don’t, they don’t know they got the muscles they don’t know they can. The landlord because they are intimidated by the landlord. They’ve never gone through this process before. Sometimes it’s a team plays against the tenant. It’s the landlord. It’s the landlord’s attorney. It’s their leasing. Rep. It’s their property manager and their shifts a person wanting to open his first or second restaurant, right not knowing what’s real and what he can negotiate.

Roger Beaudoin 0:34

Welcome back to the podcast. Thank you for being with us. The vast majority of restaurants out there are leaseholds. They’re in leased spaces. And very few of us maybe are experts at negotiating a lease knowing the ins and outs of what to look for the right questions to ask. It can be really uncomfortable to negotiate your best deal. But before you can, you need to know everything there is to know about a lease and that is exactly what this episode is about. With me is a leasing expert. We’re going to cover all the bases so you’re not gonna want to miss it. Stay tuned.

Intro/Exit 1:10

You’re tuned in to the restaurant rockstars podcast, powerful ideas to rock your restaurant. Here’s your host Roger Beaudoin.

Roger Beaudoin 1:24

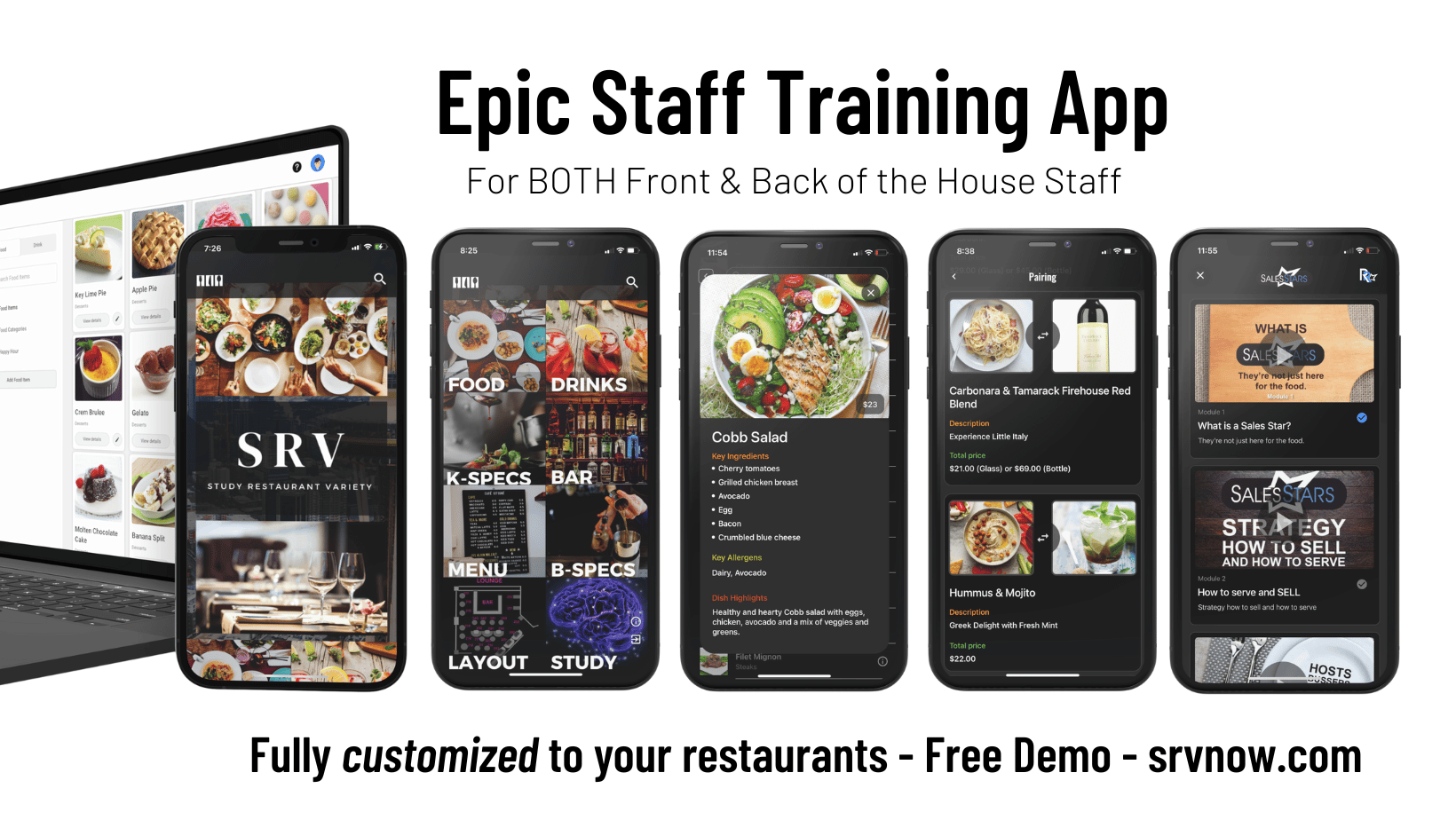

Listen, I am a huge believer that service is your restaurants greatest competitive advantage. But we all know that service takes time and commitment, dedication. Well, what if there was a training tool, a single tool that was completely customized to your restaurant brand, your menu. Let’s start with photos of the plate presentations, ingredients, romance, notes, allergens, everything that’s important that your staff need to know to present and bring to life your menus for your guests. That includes your wine and beer list, specialty cocktails, everything at their fingertips. Imagine in the back of house that cooks, your new prep cooks or anyone can instantly look at the photos, elicited ingredients with prep times and cooking steps all the important things to produce each dish to perfection. Imagine there’s also table layouts of every dining space in your restaurant with table numbers and even seat numbers because we all know how important it is to deliver the right dish to the right guests. This is a tool designed to enhance hospitality in your restaurant, not replace it. Learn more at surf now.com. That’s srvnow.com Check it out.

Roger Beaudoin 2:32

I call this the business of 1000 details and you’ve got more important things to worry about than calculating and paying your monthly sales tax on time. Well, that’s what Davo comes in. Davo puts sales tax on autopilot for restaurants. davo uses sales tax data from your point of sale system to set aside the exact amount of sales tax you collect every single day, and then files it and pays it when it’s due on time for your restaurant every month. Davo takes just five minutes to set up. And once it’s up and running, you never have to worry about paying sales tax again. Devil costs 49.99 per POS connection per month, and your restaurant can try Davo for the first 30 days free davo was created by a successful restaurant chef and owner who knows what’s important for your operation. Time is money and you’ve got more important things to focus on, like pleasing your guests. You can’t put a price on peace of mind. Why not try Davo for the first 30 days at Davosalestax.com

Roger Beaudoin 3:31

Welcome back, everyone. This is the restaurant rockstars podcast and with me today is Mr. Dale Willerington. And he is also known as the lease coach. So this is going to be a very robust episode all about leases and negotiating and all the empty space out there right now unfortunately, due to lots of closed restaurants, there is a lot of opportunity to get into this business or to find additional spaces. And you know, not any of us are really experts on negotiating leases. But Dale certainly is so welcome to the show. Dale.

Guest 4:00

Thank you Roger. I was hoping that one day I would become famous enough to appear on restaurant rockstars Oh, you’re too good. made it. I made it.

Roger Beaudoin 4:08

Oh, Iknow. Well, Dale, you’re the author of a book and it’s called, obviously negotiating leases, commercial leases and renewals for dummies. I mean, everyone’s heard of this series for dummies. So this is great. I’d like to talk a little bit about this as we get into it. But as my guests No, we always start with the backstory of my guest and where did it all begin for you? Well, fortunately,

Guest 4:27

a lot of my education came from working on the landlord side of the table. I used to be a shopping mall manager. I used to be a leasing rep for landlords, it was my job to collect the rent. I did all the dirty work for the landlord and I got to see what was going on behind the scenes and I was sitting behind my desk as a mall manager in a shopping mall in 1993 in thought, you know, landlords don’t really need my help. They’ve got plenty of people to help them. It’s the tenant. It’s these tenants that come through my door and say all kinds of things they shouldn’t be saying and giving the information and leaving a lot of money on the table. So, in 1993, I stopped working for landlords, I became a professional lease consultant started giving seminars, the book that you just held up my for dummies book is actually my third book. Okay, I’ve done this a few times. This is my 30th year in business. So it’s absolutely phenomenal to be working on the tenant side, it’s much more enjoyable to hit a home run for a tenant.

Roger Beaudoin 5:28

Well, hallelujah, that now we all know that there’s lots of opportunity right now. But is it a good time for tenants to be looking for leases Do they have any kind of advantage over landlords simply because there is a lot of space vacant that landlords want to lease

Guest 5:43

80% of the time, Roger, the tenant has the advantage, no matter what the economy is, no matter what’s going on, they just don’t know it. It’s like being the strongest man in the room. And they don’t, they don’t know they got the muscles, they don’t know they can lift the landlord because they are intimidated by the landlord. They’ve never gone through this process before. Sometimes it’s a team plays against the tenant. It’s the landlord. It’s the landlord’s attorney, it’s their leasing. Rep, it’s their property manager. And there sits a person wanting to open his first or second restaurant, right, not knowing what’s real and what he can negotiate. So yes, it’s a great time economy wise, to go out and lease space. But as you know, certain restaurant cuisines certain categories within within the restaurant category are doing better than others as we come off the pandemic,

Roger Beaudoin 6:39

for sure. Absolutely true. You know, this brings me back, it had to be 25 years ago, and I knew absolutely nothing about the restaurant business. And I was in that person’s shoes. And of course, negotiating a lease, I had never done that before. And I had a partner and the two of us saw space. Well, you know, we walked away from a couple of spaces, the very first space had a certain, you know, monthly square footage, but then there were very expensive fit ups, because it was a raw building that was just put up. And we suddenly realized, okay, it’s gonna take a lot of money to put in all these fit ups. And then you can’t take those away when you leave when the lease is over, and the next tenant benefits from your fit ups and all that sort of thing. But the location was absolutely stellar. So, you know, tenants run into this problem all the time. And what I’d really like to get into is, there’s sort of a balance between the cost of a lease versus the location. And you got to weigh all those options and sort of evaluate what are the chances of my business being really successful in this location versus that location? Take us through that whole mindset. Before we get into the negotiating process, when people are just driving around in their cars, and they’re looking at spaces before they even talked to anybody, what should go through, you know, a new business operators head in terms of evaluating spaces.

Guest 7:55

I just finished speaking at the New York restaurant show for the 12th year in a row, I think, and one of the things I really drove home with these startup restaurant owners is that they really have to decide in advance, are they going to go for first generation space? Or are they going to go for second generation restaurant space, because the cost of building the mode is going to be a lot different, right? If we’re taking a raw shell or a vanilla box, the bathrooms have to be put in every the wiring, sometimes the you know, the age factor, I’m doing one deal right now. And the landlord’s giving the space to the tenant in such a raw condition that the tenant is actually responsible for installing the H vac systems. Okay, which most of the time the H backs are already there. Right?

Roger Beaudoin 8:44

You would show it hope so for sure. That’s, that’s a basic absolute essential the heating, you know, ventilation and air conditioning, all that kind of stuff, that that can be extremely expensive for a tenant to pay for it, especially if it’s a lease and you don’t own the property,

Guest 8:58

we’ll see even if the even if the landlord is willing to contribute tenant allowance or money to offset the cost of the H back installation, the tenant may not be sophisticated enough and comfortable enough to start going to that extent, right. You know, if it’s an existing restaurant location, you can walk in and kick the tires, you can check the bricks and mortar, everything’s there. So you have to make that decision. Which way am I going to go first generation, you know, brand new raw space or second generation space. Once you do that, then you really have to decide if you’re going to use a broker or not. Okay, because a lot of times use when a tenant tells when I ask a tenant, Roger, why, why do you why are you using this broker? They’ll say, Well, Dale, it was actually kind of an action and I went to see his listing. It wasn’t good for me if he said he’d show me a couple of other locations. And before you know it, you’re working together and this broker is you know, representing you one way or the other and that It really wasn’t your intention because when it comes to commercial real estate, there’s a lot of Commission’s being paid in commission splitting. And the frustration level, the frustration level that restaurant tenants tell me about when they work with brokers is not surprising, because remember, the the broker is getting paid by the landlord, right? I don’t call myself a tenant rep, because the commercial brokers in the industry who do call themselves tenant rep still get paid by the landlord. And I think that then it becomes an oxymoron. I see. Right? It just, it just doesn’t work. So so they have to make that decision, whether they’re going to get a broker, and you know, choosing the size of the space they want. Here’s what happens in the real world, Roger, you start looking at places and various plazas. You might have your sights set on 2800 square feet. That’s, that’s the size you think you need for your restaurant. But the only thing available is 3400 square feet, or 1800 square feet, so on instantly, you begin compromising on what would have been your ideal size. And remember, you’re paying the rent per square foot. If you can drive a minivan, you don’t want to have to pay the rent on driving a bus,

Roger Beaudoin 11:07

of course. Well, that brings up an interesting point, because a lot of potential new operators aren’t really thinking ahead to Okay, what if I’m super successful, and I want to expand if the space is too small, maybe it’s worth paying a little bit more now to have the room to add more tables later. And the cash flow if the place is successful will more than cover that. I mean, you got to look at so many different things when evaluating a space.

Guest 11:31

Absolutely. And you know, the the brokers getting paid a commission based on the total rent that you’re going to pay, so they’re never going to talk you down from 3000 square feet to 2000 square feet, because that really cuts into their commission, right? They expect you to know that and understand that what you said is correct. But here’s the real world scenario. Yeah, nine, nine out of 10 Restaurant tenants that come to me because they want me to negotiate their lease renewal, or they’re opening up another one bait nine out of 10 Tell me if they could they would shed some square footage 90% would rather be smaller than bigger

Roger Beaudoin 12:09

in these times. nimbler is better, of course. Yes.

Guest 12:12

And it often harkens back to their sense of optimism. Okay, it’s 400 square feet too big. But, you know, we’re going to grow into it. We’re going to make it work, you know, but after five years, maybe not.

Roger Beaudoin 12:24

Not answering your phone is one of the quickest ways for your restaurant to lose a potential customer. But between serving in person customers and dealing with the kitchen, it’s hard for staff to prioritize incoming calls. That’s why your restaurant needs popmenu answering simple questions to keep your phone line tied up can be handled without pulling a staff person from your in person hospitality. Reclaim the power of your phone. Popmenu answering is powered by artificial intelligence to answer the simple questions most people call in with like, do you have outdoor seating or what are your hours within the pop menu platform you can customize answers for your restaurant and choose the voice your guests here. Plus create customized greetings. Popmenu answering picks up your phone 24/7 365 days a year turning every phone call into an opportunity. Plus popmenu’s full collection of tools helps optimize your restaurants website and menu streamlines your ordering experience and assists in retargeting to enable you to build long lasting relationships with your guests. Get help answering your restaurants calls now with pop menu answering. And for a limited time, my listeners can get $100 off their first month plus an unchanging monthly rate at popmenu.com/rockstars. Go now to get $100 off your first month at popmenu.com/rockstars.

Roger Beaudoin 13:50

Let’s talk about opportunity because that word came up when we first started this obviously there are a lot of spaces that are for lease and no time. Can I remember in history and you may or may not agree with this. Have there been more spaces that already have furniture and fixtures and range hoods and walk ins because if you can find a space that was a previous restaurant, a lot of these things are not takeaway items. They’re literally built into the space. Are you seeing that?

Guest 14:15

Yes, you’re absolutely right. And you know, in our industry, it’s called the landlord will often charge a turnkey fee as well, right? The previous restaurant tenant failed right and left behind their their hood and their grease trap and maybe even their tables and chairs and all kinds of other things. Or maybe the landlord locked them out. Right? They didn’t pay the rent. And so now the landlord says, well, I’ll I’ll lease you my space, but I want $85,000 of turnkey money because you’re gonna get to use my equipment now. Or I see. And I was doing I was doing a lease renewal for one of my multi unit restaurant clients in California recently and right on the last page of his lease agreement, Roger it said, this is all the equipment that’s in this space. When you take Over casing, when you’re signing your lease, and you’re taking over this is all the equipment that’s in this space, and it’s owned by the landlord. Right? Well, eventually that equipment starts falling apart and breaking down and you have to replace it and you have to repair it. So as part of his lease renewal, I negotiated with the landlord to sell him the equipment for $1. Okay, so he now owns all of that equipment. Now the equipment doesn’t have that much value, but at a point in time where he goes to sell his restaurant, he can’t even claim those those are his assets until we get this in the lease.

Roger Beaudoin 15:30

This is really interesting. Let’s just go back to that $85,000 turnkey fee, it talked about let’s just say a restaurant, a new restaurant or the person that negotiates the lease agrees to that. And then something breaks down, does that mean that that landlord is on the hook to repair it or replace it or make it work? Because I’m not paying for the use of that equipment is, does that work that way?

Guest 15:51

No, the tenant is 100% responsible not only to ensure the equipment, but make sure it’s working properly. And to return it to the landlord in the same condition.

Roger Beaudoin 16:01

Let’s let’s get into negotiation now, because it seems like a perfect gear change. Now, there are a lot of people out there that are uncomfortable in these types of positions. And that’s why you’re an expert at this. But some people might be, you know, averse to conflict, or they just don’t like these heated discussions it you have to have a certain negotiating approach and style. You can’t just walk in there and just expect that everything’s going to work out in your favor. But negotiation really in the best of senses means a win win, you know, the landlord wins, the tenant wins, everybody’s happy. And that would be a perfect world scenario, you probably don’t see that a lot. But it’d be great if that’s what we’re shooting for. What are the keys to negotiating and part of your book talks about having your ducks in order before you walk into approach the broker or, or the property manager or the landlord and you know, you have to have a certain savviness about you, you’ve got to have your homework done. You’ve got to be knowing what you’re looking for, and be able to take a firm stance, it’s kind of like a poker game. You’ve probably heard that analogy for a lot of bluffing goes on, doesn’t it?

Guest 17:06

Well, that’s right. And you know, I just booked a trip to Vegas. I speak at conventions there. And I’m not a gambler. But if I was a gambler, I don’t think I would be bluffing as a strategy. Right? So one of the things tenants need to do is they need to negotiate on multiple locations simultaneously, if you’re focusing all your efforts on one location, right, it’s hard to get some traction, no leverage there. Yeah, no leverage. Exactly. And, and so what I see tenants doing that really cripples them, is they call up the real estate agent, or they go to see the space and they say, you know, I think I’d like to lease the space, I’m going to open up a, an Italian restaurant. And now because you’re kind of asking if you can do that, if that’s your approach, you’re asking, they come back and say, well, you’re gonna have to earn it. Let’s see your profit. Let’s see your financials. Let’s see your net worth let’s, you know, what’s your, what’s your restaurant experience? What I do, if I’m contacting if I’m doing site selection and contacting a broker, right, because typically 90% of the properties have a for lease signed by a broker on the window, and that’s contact. Yep. And I contacted and I say, Mr. Broker, do you think the landlord would like to have an Italian restaurant in this location? Yeah, we really would. Okay, so now you see I’ve got something they want. If you go to them and say, I want to lease your space, well, they’re going to put you through hoops and loops. The important thing is, you want to be the, the batter, not the picture. You want them, you know, the tenant is the landlord’s customer. But you’ve got to act like the customer.

Roger Beaudoin 18:42

You know, there’s something also in the book that says the customer’s always right, but that is not necessarily the approach to have when you try to negotiate a lease. Well just say about that, what do you think? Well,

Guest 18:51

it’s surprising how many tenants say to me, Dale, I just want a win win deal. Okay, there’s you heard of the book a win win negotiating Well, I don’t believe in Roger I don’t believe in Win Win negotiating. I want to get my client the tenant as much as I can, if I can get him nine months of free rent and or $300,000 tenant allowance and all kinds of landlord work done to the space and new H HVAC systems. You know, that may not be Win win, but I mean, to win for the tenant. Okay, if I get, you know, tenants compromised all the time, a tenant will frequently sign a deal. They later regret. Landlords never sign a deal. They regret landlords know when to stop. You see? So if I over ask like, like I shared this story and usually get a pretty good chuckle out of it because a franchise tenant, he had three locations and he said, Dale, I’m gonna open up three more locations. I want you to do my site selection, start looking for spaces. Don’t show me any location where I can’t have at least three months of free rent. Okay. So I went out and did my work. Three weeks later, I come back to him. I said, here’s here’s the stack of locations. This is The one I’d like to talk to you about first I said, But you know, I did not get you three months of free rent. He said, Well, I’m he was livid. He said, I don’t even want to look at this. No, hold on. I got your 12 months of free rent five year lease with the first 12 months free. He was flabbergasted. How did you get me 12 months of free rent? I said, Well, you’re gonna have to pay me more, if you want to know that, you know? And after he stopped laughing, I said, No, I asked for 18, I asked for 18 months of free rent and got 12. So he would have asked for three, cuz that’s what he wanted. And he would have gotten two or one and thought he did pretty good. So too often the tenants are too timid, or they’re just not that knowledgeable about how much they can ask and negotiate for. And they tend to ask for what they want. And then when the landlord counter offers, the tenant gets less than they want. Right? So if my client needs $100,000 tenant allowance, I’m probably asking or negotiating or offering for 150.

Roger Beaudoin 20:53

That’s so interesting, because if I brought you as my expert in, you could shoot for the moon and the landlord is literally, you know, like you said, we’re in a position of leverage, especially for looking at multiple spaces. But if I was to walk in there by myself and ask for the moon, more than likely that broker representative, the property manager, the landlord himself will say, yeah, right. Are you crazy? What are you thinking? But in these times, Dale, is it really that realistic? Or that many spaces in certain areas in this country, where the tenants are really in that kind of driver’s seat position? Are you seeing that?

Guest 21:27

Not to the extent that one might think like, we went through hell the last couple of years, right? I mean, this was crazy devastating. But no, because I work right across the country. Roger, I can, you know, there’s big differences between, you know, the landlords in New York and the landlords in California, and Denver and

Roger Beaudoin 21:45

the Midwest and everything in between, there are certain areas where

Guest 21:49

the tenant can literally write their own check, they can think they can basically dictate their terms. But some of the tenants that have failed, or some of the restaurant tenants that have left their location, they were in pretty good locations, and they left behind hundreds of 1000s of dollars of leasehold improvements, and other restaurant tenants will jump in there, even if they don’t get a really good deal. So it’s better than it was before from a tenants perspective, but not, you know, not overly

Roger Beaudoin 22:20

now let’s, let’s assume that we’re a new business operator, and we’re completely green. And we have a dream. And we have an idea. And we’ve got some money in our pocket, and we’ve got our financing lined up and everything’s rosy. So it seems, and we’re going in to negotiate a lease for the very first time. Is it smart? Or is it reasonable? To ask for, say, a short term lease to start with option to renew in case things don’t work out? So you don’t get stuck on the hook? Or is it better to ask for an assignment clause, or if things don’t work out, I can find a new tenant to go in there. So I’m not on the hook for, you know, a three or a five year lease when this business lasted six months, and I’m out. I mean, it’s a huge, huge risk, especially if you don’t know what you’re doing. You know what I mean? What would you suggest?

Guest 23:05

Well, most restaurant tenants borrow money to open their restaurant, and they want to pay that back over a long period of time, right? And the bank will often the bank will often say, Well, if you want a five year business loan, then you’re you need to show me a five year lease, right on a one year lease. Yeah. And so if if my client is if we’re spending a million dollars or more on developing a restaurant concept in a location, we’ll typically do a 10 year lease. Okay, with renewal options. I’m finishing a project literally today for a client in Florida. And of course, Roger, just to put something into perspective, there’s 2 million lease renewals in America every year. There’s not that many startup new leases, you know, 100,000 or so. Right. So the majority of the people watching this are actually are actually existing, you know, they’re watching your show, because they’re an existing restaurant owner, and they may want to open up other locations and right, but the deal that I’m finishing in in Florida right now. So we’re doing a five year renewal five year renewal term with a five year option. But I negotiated for the for the tenant to have the unilateral right to terminate the lease with six months notice. Okay, so better to have a long lease with the right to terminate, yes. Now then that means in short leases, where they can hold your feet to the fire, if you know if there’s more demand for the space later on. It always comes whenever I’m talking to a client yesterday, I was talking to a client on the phone and I said to him, Hey, tell me this. How many tenants are in your Plaza? You know, and they say, well, there’s there’s 14 tenants and two buildings, 14 tenants. How many spaces are vacant? He says, Well, four spaces are vacant. I said, Okay, we’re in the driver’s seat. If they’ve got four spaces, they can fill. They’re going to have to earn your tenancy. I’m not going to gift wrap you and hand it to them on a silver ladder, right? But if he’d said to me, oh, Dale, this is a wonderful Plaza, we never have turnover. Everybody that’s been here has been here for more than 10 years, there’s no vacancy? Well, that’s a much harder hill to climb because the landlord has a property that’s desirable.

Roger Beaudoin 25:14

That is a very interesting point about leverage is it is the does the research exist? And how can a potential business operator figure out which landlords have multiple spaces that are all vacant as a point in negotiation? Go walking in knowing this guy wants to lease because I’ve got five vacant properties right now that I’m trying to fill? Right is that readily available information and where

Guest 25:40

it is the the majority of tenants come to me having picked one or two plazas they think would be good for their restaurant, right? So they have the luxury of being able to drive the plaza take pictures and send them to me, okay. And so, so visually, they can they can see, okay, that’s vacant, there’s a for lease sign in the window, or it’s papered over. But when they send me pictures or when they when I when I investigate the property on on the on the landlord’s website, okay. I can see certain because we know which industries are weak. And I say, you know, that that that that flower shops probably not going to make it. Okay, it’s got 1800 square feet, you could probably get if we see, a tenant will sometimes say to me, Well, I really want to be in Plaza, ABC, but there’s no vacancy, say, Well, let me call the landlord, because that flower shop in Plaza ABC might be hoping and praying someone comes along and takes them out of their misery. You see, and the landlord says, Well, yeah, they’ve still got two years on their term, but they told us they’re not going to be renewing. They’re not doing that. Well. So would you like their space? We’ll let them out early, and you can come in and take their space. So that’s part of the process to

Roger Beaudoin 26:55

is there a benefit? We talked about plazas? That could be a strip mall? That could be a shopping mall? That sort of thing? Is it a good idea? Because there’s such already built in traffic with huge anchor stores that draw huge amounts of traffic versus a standalone location? I mean, every situation is different. But do you see greater successes in these thriving plazas or malls versus, you know, here’s a street that seems to have a lot of traffic on it. But it’s a standalone building that people may pull into the parking lot. They may not, you got to build the business with branding and marketing and all that other kind of stuff. versus people are just gonna walk by my shop. And if they like what they see from a curb appeal or a visibility standpoint, they’re going to come in, I mean, what would you say?

Guest 27:37

Yes, if if it’s a fast casual or less than a fast casual restaurant, quick service restaurant, because I’ve never just, you know, been walking through a plaza and said, Oh, I’ll go in for a steak dinner. Okay, if you’re going out for a steak dinner, you typically plan a destination, you’re going down, you make a reservation. But if I’m doing site selection in Chicago for a client, and it’s one o’clock, and I haven’t had lunch yet, and I’m looking at the fourth Plaza for the day, and there’s you know, and there’s a quick service restaurant, I might go in and, and get something on the fly. So yes, traffic really does count. The thing that tenants have to watch out for is the lack of parking. Okay, like I was doing a lease renewal for a restaurant tenant in San Antonio. And this was their story, which is so interesting. They said over a period of 15 years in the plaza. The retail tenants were moving out and more restaurant tenants were moving in. So now there was a disproportionate share of restaurant tenants in this plaza. Now they all had their own cuisines with Mexican and Italian and Asian, all different kinds of cuisines. And so they weren’t competing at that level, like one restaurant does compete with another but I said, Well, what’s the big problem? He said, Well, customers will make a reservation at our restaurant. They’ll drive up at seven o’clock in the evening, there’s no place to park because it’s all restaurants taking all the same parking it all the same time. They walk in and cancel their reservation and drive away. Okay. So in some respects, it’s it’s, it can be more about the parking than about the foot traffic. It depends where you are.

Roger Beaudoin 29:15

Alright, you made it really clear about fast casual in strip malls and shopping malls versus a fine dining experience or a sit down really nice. You know, restaurant, we’ve all seen different areas of the country where certain businesses really thrive when there’s lots of competition for that same business like car dealerships, you’ll drive down the street, there’ll be 10 car dealerships all on the same strip because they know that car shoppers are going to come to that area and they’ll probably visit two or three or four of them. And you know, business drives more business. Does that apply in the restaurant industry? Are there certain areas where it’s good to be surrounded by lots of restaurants because people just know that’s the area where the restaurants are, or should you shy away from that as new operators

Roger Beaudoin 29:57

get big flavor without the labor with smoking fast from Smithfield, it’s fully cooked or smoke proteins, including American barbecue staples and global flavors. Everything from ribs to pull chicken to brisket and barbacoa. All are authentically slow cooked to perfection. It’s so delicious. Your guests will never know it wasn’t smoked right in your own kitchen. Now you can add barbecue to your menu without adding a pitmaster. To your payroll visit Smithfieldculinary.com.

Guest 30:29

Short answer is yes. And I’ll take you back to when I was a shopping mall manager. And in the in the, in the food court, we had like eight tenants, right? And we have the hamburger guy and the pizza guy and you know, every different kind of cuisine in the food court. So definitely the the assortment of variety can make, you know, can make quite a difference in attracting people. And occasionally, my wife and I will go out for dinner and we said, well, let’s just drive over there. There’ll be one or two, we’ll see which one has the longest lineup or which one we can get into that type of thing. So, so yes, I think I think there is a lot to be said for that.

Roger Beaudoin 31:05

Okay, let’s talk about what exactly do you mean, in your book by a profitable lease agreement? What does that mean?

Guest 31:14

Well, a profitable lease agreement should be when you sell your business, you you can take your profit and walk away. Okay? I mean, you can you can say it’s also the the day to day operations. But the truth is, most restaurants are not that profitable. On a day to day, month to month, year to year basis, this limb lives in business. That’s right, and five or 10, or 15 years later, when they sell the restaurant, that’s when they cash out restaurant owners often say to me, this restaurant is my 401k. When I sell, that’s when I’ll have my money because right now I’m just earning a modest living and working 45 hours a week and yep, and so on and so on. So a profitable location should should simply a profitable lease should simply be that one that allows you to pay a reasonable rent, because in every industry, every industry has a different operating option, occupancy cost, as we say, my point is, most people would would agree that if your restaurants doing $100,000 A month in sales, then about 10% of that should go can go to gross rent. 10% Okay, that’s,

Roger Beaudoin 32:22

that’s a good benchmark.

Guest 32:25

And I’ve got clients paying 14%. And I’m saying, Well, are you profitable? And they say, not really. So 14% of their gross revenues is going to the gross rent. I’ve got clients that are paying seven or 8%, they’re doing so well. And they’re the rents not an issue for them. Their staffing is their big issue. Of course, right now, at this point in time.

Roger Beaudoin 32:44

Well, that’s more of a balance. Because again, if you can’t find a 10% lease, but you can find a 14, that just means that your food, beverage and labor costs need to be lower or really, really strong in order to meet that additional, you know, rent cost.

Guest 32:57

Yes. Yeah. See, it’s really important for the for the listener here to understand there’s often two different answers, there’s an answer for the startup tenant opening their first restaurant, and there’s an answer for the lease renewal tenant. And I’ll explain why the tenant who’s been there for five years and wants me to negotiate their lease renewal, we know what their sales have been. Right? We know what their occupancy cost, right? And I said, Look, you’re paying 11.5% Right now, if I can get you a rent reduction, you know, by this much, you’ll be down to paying 9%. Right? To start a restaurant, he doesn’t know how much your sales are going to be. Great. So I will be the one to say that look, if you agree to, you know, to to pay $7,000 a month in rent, your business plan has to anticipate that you’re going to make $70,000 a month in sales, or the math doesn’t work. You won’t be profitable.

Roger Beaudoin 33:51

So a big part of your business is actually renegotiating leases and getting people better deals than they’ve had all along. Yeah, a long term situation with the same tenant landlord relationship. And suddenly you come in as the expert in their corner working on their behalf. And you can often dramatically decrease their costs, get better concessions, all these things because they’ve been a good tenant, you need that sort of ammunition to walk in saying this person has been here for five years, and they’re a good tenant, and they haven’t made any problems. They haven’t asked for anything unreasonable. They’re not annoying their neighbors, people love the business. It’s drawing traffic to your property, all that kind of stuff. But I’m sure I’m missing some things right. But what’s your approach? Can you say, well,

Guest 34:35

well, the tenant doesn’t have to be necessarily good, meaning, you know, did they pay their rent or they have a good product? Sometimes we get quite a bit of leverage. If the landlord has vacancies in the plaza. They want to even keep a port in it. Right? So Miss King. That’s right. So the the thing that really shocks people Is that when I negotiate a lease renewal 80% of the time, I can get the tenant for rent reduction on their lease renewal, not 100%? You know, I’m not Superman, but I do have some superpowers. Yeah, my batting average is about 800. Okay. And then it varies in degrees, sometimes I get them a 20% reduction, sometimes I only get them a 5% reduction. Right? It really does vary. But I approach a lease renewal negotiation. And I tried to make the landlord re earn the, the renewal as if it was a first time tenant. So I say, Well, look, Mr. Landlord, you got, you’ve got 15 tenants and three vacancies. If someone was going to lease one of your vacant units, would you give them a tenant allowance? Would you give them a rent free period? Would you be negotiable on this, this and this? And the landlord says, Well, of course, I said, Well, you’re gonna have to give me that on this lease renewal. I said, Because number one on this lease renewal, you’re not paying any Commission’s right, you’re not paying me I work for the tenant, the tenants paying my fee. So there’s no out of pocket money for you. And it, you know, I was doing a lease renewal for one of my my franchise clients. 50% of our clients, Roger, our franchise and 50% are independent. And I was doing his lease renewal. And the franchisor had a corporate mandated remodel, right? If you buy into a franchise restaurant, most of the time, you have to remodel every 10 or 15 years. So I went to the landlord and said, Well, you know, you’re gonna have to, I’m negotiating your renewal, I said, you’re gonna have to contribute substantially to this franchise or a mandated remodel, or we might as well move across the street, because we practically have to build a new store anyway. Right. So that, you know, I was able to, to, you know, to negotiate with the landlord to contribute a $50 per square foot Canada allowance for the renewal. And see, when I give seminars and speak across the country, many times tenants say to me, well, Dale, I never got a tenant allowance on my first lease, how did you get one on a renewal? Right? I remember this one client, you seven locations. And one of our other coaches and consultants had done his project, but I called him up as part of the service follow up and I said, what did we do for you? What did the lease coach do for you? You said, You did four things. We negotiated my lease renewal, you did four things. He said, I was quite surprised that you got me a rent reduction. Okay. He said, I was quite surprised that you got me three months of free rent. Now that free rent Roger was in so that he could remodel his store and not have to pay rent during those three months. Okay. He said, shockingly, you got my deposit back, because why should a tenant have a deposit forever and ever, amen. And then he said, I couldn’t believe it, you negotiated to rescind my personal guarantee. So he said, I’m in much better shape now with this location than any of my other locations. And that’s, that’s sometimes the power the tenant has after five or 10 years in the same location. If they’ve got a good rent payment history, and they’re operating a good business. The tenants just don’t know that. Right? The tenants just, you know, the tenant calls up the property manager and says, Hey, my lease is expiring in nine months, I want to do some painting and remodeling in the space, can you send over the renewal agreement? Right? And the property manager says, Well, of course we can, you know, and they type it up with a 10% increase, because you just showed all your cards you just called when I call up a property manager and I say, my, you know, I’m a consultant working for this restaurant, tenant. They’ve been in the plaza for nine years. They’re on a 10 year lease. They’ve been closed for nine years. And I’ll say, to the property manager, now I know you’re out of state. But if you’ve ever been to this restaurant, have you met the tenant in person, he says, I’ve been there. I met the tenant once when I became the property manager two years ago. I dined there once about a year ago when I came to visit the property. And I say, Well, again, coming back to what we covered before, do you you know, do you want this tenant to stay in this location? Right? And as soon as they say yes, then they have to pitch to us, they have to earn that tenancy.

Roger Beaudoin 39:02

Very good. You’re also an advocate of longer leases versus shorter leases, because chances are, you know, there are missing things in a lease. If somebody comes across a really short lease, what are some of the things you see missing that really should be in there? That could be a surprise down the road?

Guest 39:19

Well, the most comprehensive lease I’ve ever seen was when we did a we did a lease for a franchise, a restaurant franchise in Downtown Disney. It was 102 pages. No, that’s a lot of reading, right?

Roger Beaudoin 39:33

Oh my gosh, really? Now I

Guest 39:35

got sent a lease yesterday for one of my clients in California. It’s a cafe. One of my clients in California pick the leases nine pages. So I’d rather start with a longer lease because the more things that we pre agreed to the more things that are defined and outlined, you know, the better the agreement and the less room for disagreement in the future. Because when you’re arguing with your left candidates often think a tenant will say to me, well, it doesn’t say I can’t do this. It doesn’t say I can’t put tables and chairs out on the on the sidewalk. I said, Yeah, but it doesn’t say you can. Right? You should have added that in when you sign your first lease. Okay, can its tenants often think that the landlord’s going to really give them anything that that that seems reasonable when it comes to parking and signage and and patios and things like that. And there’s a lot of disagreements over that. And that’s because when I was a property manager, Roger, if you called me and said, Dale, I want to put a great big banner on the front of my space. Okay? I’ll say no, Roger, you can’t do that. Because then every other tenant will want to put up a banner. Of course, if I give you permission, right? My point is, you have to negotiate all of these things in advance. Right? Don’t Don’t say, Well, of course, the landlord’s gonna let me put up a banner all ask him about it. Once I get my restaurant built. No, we put that into the lease agreement right now.

Roger Beaudoin 41:04

So you obviously have a template of boilerplate things that the you know that the tenant may probably never think of, but a month from now, they may want that. But you literally have all that pre loaded. So think about this, think about this, think about this, because it’s too late once you sign on the dotted line, and then suddenly you say, hey, I want to put a banner on my building. And the landlord chances are gonna say, No, you can’t do that. Because

Guest 41:28

let me give you let me give you the real life example of this. I’ve got two daughters in their 20s. And I’ve bought them their vehicles, I buy them used vehicles so they can get around town. Yeah, me too. Before we before we buy the vehicle, yeah, we run it over we I happen to have a client that owns an automotive shop. So for just under $200, he will do the inspection. Sure. Okay. So the inspection, and he gives us this list, everything’s all checked off. And I have a similar 39 Point lease inspection for the lease, right. And it’s not that there aren’t going to be things we don’t want to see in there. But he says, Look your your transmissions leaking a little bit, but that’ll cost you $400, we know you’re gonna need new tires in two years, there’s, you know, the brakes are 40% worn, so you’re pretty good there for a few more years. And we have that inspection from him on paper. And we can either use it to negotiate a better deal. Or we can simply use it for the peace of mind of knowing what’s coming in the future if we do buy this vehicle, right, because it’s been inspected. And we do the same thing with the lease agreement, because the I do a 39 point lease inspection, right, the tenant or give the tenant a written report. And then they spend about an hour to two hours on the phone, talking them through it because some of these clauses are not necessarily objectionable. They are rules. And I say to a tenant, this this 65 page long lease agreement is a list of rules that you’re expected to follow. Don’t sign it if you’re not prepared to follow it. Correct. Yeah. Okay. And a really good, really good point here is business hours. Because some of my clients are in the downtown, and they don’t want to be open on the weekends, they want to, they want to be open on the evenings, if depending on what market they’re servicing, like, like high rises downtown. If you’re in any kind of strong retail setting, they’re going to expect you to be open seven days a week, and maybe from 9am till 11pm. You can’t agree to that. Now, if that’s not what you intend to do, so we negotiate for the tenant to have the right to set their own days and hours of operation.

Roger Beaudoin 43:36

That’s very important. Yeah, I can’t imagine not reading that in a contract and then suddenly being held to the fire and you don’t have business during those hours or like you said, you’re in a downtown area. And when you know, the professionals and all the high rise, people leave, it’s like you have no business on weekends. That makes perfect sense.

Guest 43:53

Ah, facts systems are a big part of the negotiating equation when it comes to restaurants. And I was doing it the other day happened to be for a franchise tenant in in Chicago. And I said to him, Have you had the H back you’re gonna lease this location? Have you had the H back inspected? He said, No, I haven’t. It’s going to cost me $300. I don’t want to spend that money. But but they told me that when the previous tenant moved out, it was working fine. So what’s the problem? I said, Well, look, I think you should spend $300 Send somebody up on the roof and check it out. Fortunately, there was power to this unit, the power was turned on. So the not only could he go on the roof, but he could go inside and he could try to make the he couldn’t make the trek system where he said by the way, he said H Vax lasts for 20 years. This was at least 22 years old. It’s already dead, right? And so we went back to the landlord and got the landlord to install a brand new $8,000 h max system because we could prove to them on paper with this inspection that it was dead. It wasn’t working at all right? Sometimes we’ll negotiate to get a warranty Um, the landlord on the H vac system, but there’s a lot of buyer beware, you have to kick the tires and test drive the car and do all the things you have to do you have to get your contractor in there to look at it. Right.

Roger Beaudoin 45:12

You know, that’s another interesting point, whether it’s, you know, HVAC, the boiler system itself, the heat, you might have a furnace in a building that’s 25 years old, and you sign a lease, and it’s the middle of winter. And now crazy times where, you know, certain people and, and the trades are not available, they got long waiting lists to go service people and you could be out of business for days before something gets fixed. If you didn’t inspect all of these things. There’s so many things to look at. There’s so many potential pitfalls out there. So it certainly helps to have a professional in your corner. Do you still see common area maintenance charges? Or is that not built into a lease? You know, because 25 years ago, I had a cam charge that was sort of an eye opener for me that when we are negotiating leases, we didn’t take that space, but it’s like, okay, it’s 15 bucks a square foot. And by the way, now you’re paying an extra $3 a square foot to shovel the, you know, the shovel the walkways, and clean the windows and you know, landscape and all that kind of stuff. And we’re like, Wow, that’s crazy. What do you see now?

Guest 46:11

If a property has cam charges, common area maintenance fees, that means it’s a triple net lease. Okay. So there’s there’s basically there’s really two kinds of leases, there’s a gross lease, a gross lease is where you pay let’s let’s say you agree to pay 8000 a month, you pay 8000 a month, no matter how much the snow removal cost is your pay 1000 A month no matter what how many times they mow the lawn, whatever it happens to be. You don’t want a gross lease, only 5% of leases are gross leases. 95%, or triple net leases. The triple net the three ends is the same thing as the cam, the common area main it means the same thing, okay. And so if you if you your restaurant occupies 12% of a building, then you’re responsible for your proportionate share, which is 12% of the common area maintenance charges. That’s the kind of lease you do want, it is the most common 95% of leases are triple net lease, you can’t get away from them. The short reasoning for this is that if you go if you’re on a gross lease, Roger, and you go to the landlord and say, How come you’re only cutting the lawn once a week, it looks terrible. It looks good for a week, and then for three weeks. It looks shabby, right? He doesn’t want to spend his money. It’s a gross lease, he thinks he’s spending his money to mow the lawn. But if you’ve got a triple net lease where there’s common area maintenance charges, then the landlord will mow the lawn as often as the tenants want. Because he’s spending the tenants money. Yes, not his own money. So there’s a lot more to this than meets the eye. And you know, we haven’t even talked about phantom space where, you know, I remember this restaurant tenant calling me up and saying, you know, how do I the landlord’s telling me about 3000 square feet? And I said, how he says how do I know it’s 3000? I said, well, first of all, it’s probably not 3000. That would be kind of a random. That almost sounds like an approximation. It’s three. If he told you it was 2,947.5 square feet, you kind of what somebody must have measured it. Right? How did they come up with that odd number? Right? And, and restaurant tenants are notorious for paying for phantom space. This is square footage. They don’t have you know, the landlord’s collecting rent on 107% of the building, we collect rent on more than 100% of the building. Right. So we I’ve literally earned hundreds and hundreds of 1000s of dollars Roger over the past 30 years re measuring tenant space. Because what happens is when we catch a discrepancy, when we see that the tenant has overpaid on let’s say, 90 square feet. And they’d been there for seven years, well, they might automatically get a four or $5,000 Check or refund from the landlord. And we fixed it for the future that’s on the base rent, then they have to do the same thing on the camp. And then we go and sign up all the other tenants in the plaza and measure their space two if something funny is going on, found money. Here’s what I want to say though, is that most of the square footage area discrepancies we come across, we believe were simply we don’t believe they were fraudulent. We don’t believe the landlord was trying to take advantage of the tenant. I remember doing one for a client. They thought they had 4400 square feet. I measured it they had 3600 square feet. That’s quite a difference. Yeah, I made a lot of money off of that one, right? Because yeah, we got we got a big rebate now. But when I went to the landlord who happened to be attorney, he said, Dale, he said when I bought this building three years ago, it never occurred to me to do a remeasurement. It never occurred to me that when I bought this property as an investment, the area measurements for the units could be wrong, but and so he was very forthcoming and very usable. And he made everybody whole Sure, but it cost him a lot of money.

Roger Beaudoin 49:47

Well, that’s interesting, because sure there are unscrupulous landlords out there trying to take advantage of a situation whether it’s 100 extra square feet or 900 like your example, but then yes, this building has changed hands and somebody buys it and it’s like they never do The remeasurement of the spaces and someone could be at a disadvantage when they negotiate if the current owner of the property thinks it’s this, but it’s really that, yes. So buyer beware, again. And it’s a good idea before you sign anything to kind of bring a tape measure along, kind of do your own measurement in the space or

Guest 50:17

there’s, you know, because of the pandemic, there’s a lot of hurting landlords out there, too. They’ve got vacancies. If you can see, the landlord has vacancies, they probably also have tenants that haven’t been paying all of their rent, okay. In the past 18 months, the lease coach has had his most profitable period of time. And I’ll tell you why. We have We literally have 1000s of clients across the country. Well, when the pandemic hit, and everybody had to close, and then there was all kinds of ripple effects. After that. They would call us up and say, Hey, can you get the landlord to defer some rent? Can they abate some rent? Can you help me, but but hundreds of other tenants came to us with that hadn’t heard of us before that we hadn’t done their first lease for and they needed the same help. And so we, we’ve literally, I don’t want to say forced persuaded landlords to forgive millions of dollars of rent to these tenants. Okay, so not all landlords are in great shape, either.

Roger Beaudoin 51:16

Are you seeing escalation clauses in a lease, especially long term leases, like it’s so much money for the first three years? And then it goes up? And the second two years and all that kind of stuff? What do you see there?

Guest 51:27

In California, I was on the phone with a restaurant client in California yesterday. And she got sent her a new proposal from her landlord. So there was a there was a rent increase. And then there was a 4% annual escalation. And I said to her, you’re not going to be able to pay that. That’s not going to work for you. Okay, and be profit, I think you might be able to pay for it, but then you’re not going to pay yourself. Right? Because isn’t that the way restaurants are often they pay their bills, and they pay themselves last?

Roger Beaudoin 51:53

Exactly right. And sometimes oftentimes, there’s not enough left to pay yourself a decent amount of money and you’re in a situation that you can’t get out of,

Guest 52:01

I’d say about a third to half of the country expects annual escalations, annual rent increases of two, three or 4%. But the rest of the country may not need it, the landlords may not be in a position to, you know, to get it and they’re just happy to, they’re just happy to collect the regular rent, let alone annual increases, it’s important to understand that it’s kind of bogus, that a landlord wants a tenant to pay an extra 3% or 4% per year in perpetuity, because the the landlord’s mortgage didn’t get any more expensive. The landlord’s already got them on a triple net lease. So the tenants are paying all the cam. So this is all profit for the landlord. Right? The landlord can’t say, Well, I have extra expenses. So your rent has to go up? No, you don’t. Your expenses yesterday are gonna be the same expenses as tomorrow.

Roger Beaudoin 52:54

But vacancy plays into that too, because if you get multiple spaces that have been sitting and not generating any income, then you sort of have to leverage all your properties. You got some winners, you got some dogs, it’s like, you know, the vacancy factors in

Guest 53:06

when I used to work for landlords if we if we saw a really desirable tenant roger that we wanted to have in the building. And they were kind of balking at the cam charges. Okay, we would give them a special deal where so let’s say the camp charges were supposed to be $8 per square foot, we might let them pay $5 per square foot, and we would subsidize $3 per square foot on their behalf. Just to get that tenant into the into the plaza because we know they came in. They’re their big brand, their name will be for bringing three or three or four more tenants will want to come in rip. So yeah, so my restaurant clients, I want to be right beside Starbucks. And I said, Well, do you because do you really want to have no parking? You really want to be beside Starbucks with no parking, right? Because who’s going to be the parking hot?

Roger Beaudoin 53:52

Yeah, good point. Let’s talk about evaluating spaces. Because that came up and you said the leverage is that you’re negotiating multiple leases simultaneously? What are the key things that you should be looking at? When you look at space A versus B versus C? You’re gonna look at all these properties with the same set of eyes, but it’s like, what are the what are the things you most should look at? Is there a checklist that you have? Are there certain key things that you absolutely should not miss? Which is typically the typical

Guest 54:21

answer is, you know, if you were talking to a broker, they would say, Well, you got to, you know, check for how many cars are driving by every day, what’s the what’s what’s the income level of the, you know, the income level of the surrounding area, and those types of things, but that’s something that tenant can check for themselves. And it’s often the city will provide that information and some brokerages even provide it. But I wrote an article once Roger was titled 1010 10 questions to ask the real estate agent before you sign a lease agreement. Okay. And that’s, that’s part of my checklist and one of the questions I ask is, who is the last First, who were the last? So I’m looking at this. So I call up a real estate agent. I say, you know, are you interested in having this, you know, restaurant and yours, but he’s Yes, we are. It’s okay. We’re going to come out and see it on Tuesday. And I think, tell me this, how long have you been the listing agent for this property so well, that he said, I have the listing for two years. I say, Okay, so who are the last two tenants to move out of this property? And he says, Well, he says, you know, he said, the dry cleaner moved out about three months ago, and the taco place moved out about a year ago. I mean, can you tell me? Did they close? Or did they relocate? It’s all with a dry cleaner move down the street, but the taco place closed for good. Okay, of course, and I can phone the dry cleaner and say, How can you move? What do you know about this landlord? My client is going to find out next year. Okay. But then I’ll say part of my 10 questions, I’ll say to the real estate agent, who were the last two tenants to move in to this plaza, right? And he says, well, the dentist moved in about seven months ago, and the the martial arts studio moved in about a year ago. Well, guess what, Roger, pick up the phone, walk in their front door, start talking to them? How was your experience when you signed your lease with this landlord? Did they? Did they pay your tenant allowance on time? Or did you have to chase them for it? Good. What issues did you get came up from this right? I was negotiating a lease renewal for for a client in, in a fairly major city. And the first time I went to see her, the space right next to her, Roger was vacant, okay, she was coming off of a tenured term. And the space next to her was vacant. When I came back to see her a couple of months later, the space next to her was occupied. There was literally a tenant in the space, right? And, and I’m not shy. So I pulled out a business card, I walked into that space. And I introduced you know, you can always walk into a restaurant, you can tell who who the workers are and who the owners are. And he was standing over there by the counter. And I said, you know, my name is Dale willerton. I’m a lease consultant. And I’m working with one of your fellow tenants on their on their lease renewal on this property. And so by the way, congratulations, your store looks great. He’d only got it partially, it was a retail store. So he’d only had it partially merchandise. I know, he’d only been open for a couple of days. And he had two customers. And I was standing there chatting him up. And I said, you know, since you’ve just gone through the leasing process, would you mind sharing with me? How the experience was for you? What’s good to work with, I sort of prompted him. He said, You know, I don’t really have time to talk to you. But he reached under his counter, he pulled out his lease agreement and said Here look for yourself. I said, well, thank you. I think I will. And I took his lease agreement. Well, he went help these two customers, I went to the court, I could see his rent his tenant allowance, I could see if he gave a personal guarantee as deposit, I can see all the business terms of his lease agreement. Now, do you think that helped me negotiate my clients lease renewal next door? Of course it did, because his was a recent deal, right? Of course. And, and candidates don’t do this. And sometimes you have to be careful because if a tenant does a bad deal, they won’t necessarily tell you they get a bad deal. They like the the lady or though they’ll give you misinformation.

Guest 58:12

So but in this particular case, I was able to see the lease agreement, and I knew what his deal was. So when I went back and negotiated my client’s lease renewal next door, I was able to pull her lease in line because the landlord wanted her to pay a lot more. Of course, right? Because she’s not where she gonna go. She’s not going anywhere. Yeah, I can help her go somewhere if she needs to, right, because if she moved across the street and other landlord would give her a big juicy tenant allowance to attract her into that space, because there is a lot of truth to the fact that it’s pockets of pockets of of the country where landlords are almost giving away space. Okay, I became aware of a situation this was not my plan. But I became aware of a situation yesterday where a failed restaurant owner was approached by a landlord to cooperate with them and open up a restaurant in their building. Okay, and they were going to jointly sort of own it and work together on it apparently, or something like that. And I thought that landlord really anything that was not the landlord’s first choice, the landlord doesn’t want to be in the restaurant business. They must really need a restaurant. If they’re bringing in someone that failed to duplicate a concept in their building. Because the restaurant food service and coffee Roger is an amenity to a plaza. It’s an amenity to a property. The popularity of a property often revolves around if there’s good places to eat.

Roger Beaudoin 59:35

Yes, I totally see. I totally agree with that. Well, I’m getting the sense that it absolutely pays to work with an expert such as yourself based on what you’ve been able to achieve for your past clients. You know, it’s not a cost. It’s an investment in savings in the future and in getting a better deal. So you’ve well done a tremendous service being on the podcast today. Well,

Guest 59:56

thank you. Thank you this this really is my passion. This is a exactly what I was supposed to be doing with my life. And I and, and part of the reason I’m successful is I have fun at it. But I’m very objective. And if my client has unreasonable expectations if the restaurant tent thinks he should get this, this and this, I’ll be straight with them. You know, nobody’s Yes, man. I can I can. I can. Because I’m not working on a commission. I get paid. Sometimes. I earned my whole fee by stopping the restaurant owner from signing the wrong lease making a mistake. Yeah, yeah. Because I say, How much is it going to cost you to hire me? Or how much will it cost you? If you don’t hire me? How much are you going to leave on the table, and I do a little thing at my at my seminars, Roger, were at the end of my seminar to demonstrate this, that using a professional lease consultant is not an expense, it’s an investment in your in your restaurant, I will ask people in the audience is anybody have a, you know, a $1 bill, and somebody will put up to bring it up, and they bring it come up with a $1 bill. And I get I trade them, I give them a 10. And they give me a one as anybody else have a $1. But now everybody’s got someone else. And they give me a one and I give them a five. That’s what it’s like, when you hire the least coach, we’re giving you far more value, you’re actually paying us 50% Of what you’re paying us, for us to negotiate the financial terms, which 50% is to work on the formal lease agreement, very few of our clients use an attorney or want to use an attorney. Okay? The legality of the lease is not really in question. But they want someone who’s done this a few 1000 times. Yeah, for sure. You know, to do it for them.

Roger Beaudoin 1:01:29

And therein lies the value. If any of our audience are interested in working with you or just getting more information, should they just go to the least coach.com? Or is there another way to contact you two preferred

Guest 1:01:39

ways, if you go to the lease coach.com, you can actually request a complimentary copy of this book. Okay. Book a consult with me, I won’t sell it to you. I’ll send it to you for free. And there’s a forum, you just fill out the form. And it’ll say, you know, would you like a consult? Would you like a copy of our rate sheet of our services and fees. And we do like a free book, and check all those boxes and we send it out. But you can email me Dale willerton at the lease coach.com Dale willerton At the least coach.com as well. And you’ll get it you’ll you’ll get a personal response from myself. And you know, I’m very giving with my time. Sometimes they only need a few minutes on the phone to kind of ask a couple of quick questions. But more often than not, they need the full enchilada they need they need some help from professional tenants don’t get what they deserve. They get what they negotiate. Roger,

Roger Beaudoin 1:02:34

that. That is a famous phrase. I’ve heard that before. But it is absolutely true. And what a great way to end the podcast. Well, thanks so much, Dale, you’ve offered us tremendous value today. And you’ve been giving very generous offers in the consultation in the free book. So obviously, we’ll pass that on in the show notes as well as what we’ve heard in the episode today. Thanks, everyone for tuning in. That was the restaurant rockstars podcast and we’ll see you all in the next episode. Stay well, everyone and thank you very much, Dale. Thank you, Dale, for being with us on the podcast. You shed so much expertise and knowledge and just great advice on negotiating a lease something that most operators are going through or will go through, especially at renewal time, or if it’s their first restaurant and they’re going into a space. Again, valuable information. Thank you. Thanks also to the sponsors of this week’s episode pop menu Smithfield culinary Davao and serve the restaurant training app at SRV n o w.com. Can’t wait to see in the next episode. Stay tuned and don’t miss it.

Roger Beaudoin 1:03:41

People go to restaurants for lots of reasons. What the customer doesn’t know is the 1000s of details it takes to run a great restaurant. This is a high risk high fail business. It’s a treacherous road and SMART operators need a professional guide. I’m Roger. I’ve started many highly successful high profit restaurants. I’m passionate about helping other owners and managers not just succeed, but knock it out of the park. You don’t just want to run a restaurant. You want to dominate your competition and create a lasting legacy. Join the academy and I’ll show you how it’s done.

Intro/Exit 1:04:14

Thanks for listening to the restaurant rockstars podcast for lots of great resources, head over to restaurant rockstars.com See you next time.

The three costly mistakes you could unknowingly be making?

Find out in this FREE guide and restaurant assessment specifically designed to reveal the unexpected hurdles standing between you and exponential business growth.

Thank You To Our Sponsors

Automate Your Sales Tax. Why Not Try Davo FREE for 30 Days.

SRV teaches your team to profitably sell and accurately create the food and drinks at your restaurant.

Unlock Staff Potential and Maximize Sales

For a limited time only, popmenu is offering our listeners $100 off your first month plus an unchanging lifetime rate.

Request a DEMO:

Inspiring Head-Turning Menu Creativity

Culinary Trends & Chef Inspired Recipes - Learn More

Want to become a podcast sponsor?

Please get in touch with Roger at roger@restaurantrockstars.com